Credit Risk

We provide continuous monitoring across thousands of corporate borrowers, using adverse media as an early warning input within the credit risk assessment process.

By systematically identifying negative developments reported in the news, our indicators support the early detection of potential credit deterioration and emerging risk concentrations.

The solution is designed to complement existing credit risk frameworks and integrate seamlessly into ongoing portfolio monitoring and governance.

Early Identification of Credit Deterioration

Timely

Our news-based analysis delivers early insights into credit deterioration well before such risks are reflected in traditional credit metrics.

Complementary

Designed to integrate seamlessly with existing credit risk frameworks, providing additional, independent information to support assessment and monitoring.

Pragmatic

AI analyzes large volumes of news to surface a small number of actionable alerts, which are then reviewed by experts (on average, one warning per 1000 companies per week).

The early warning solution directly addresses supervisory priorities highlighted by the European Central Bank.

This includes over-reliance on ratings, lagging data, and insufficient early-warning capabilities — particularly in SME and other vulnerable portfolios.

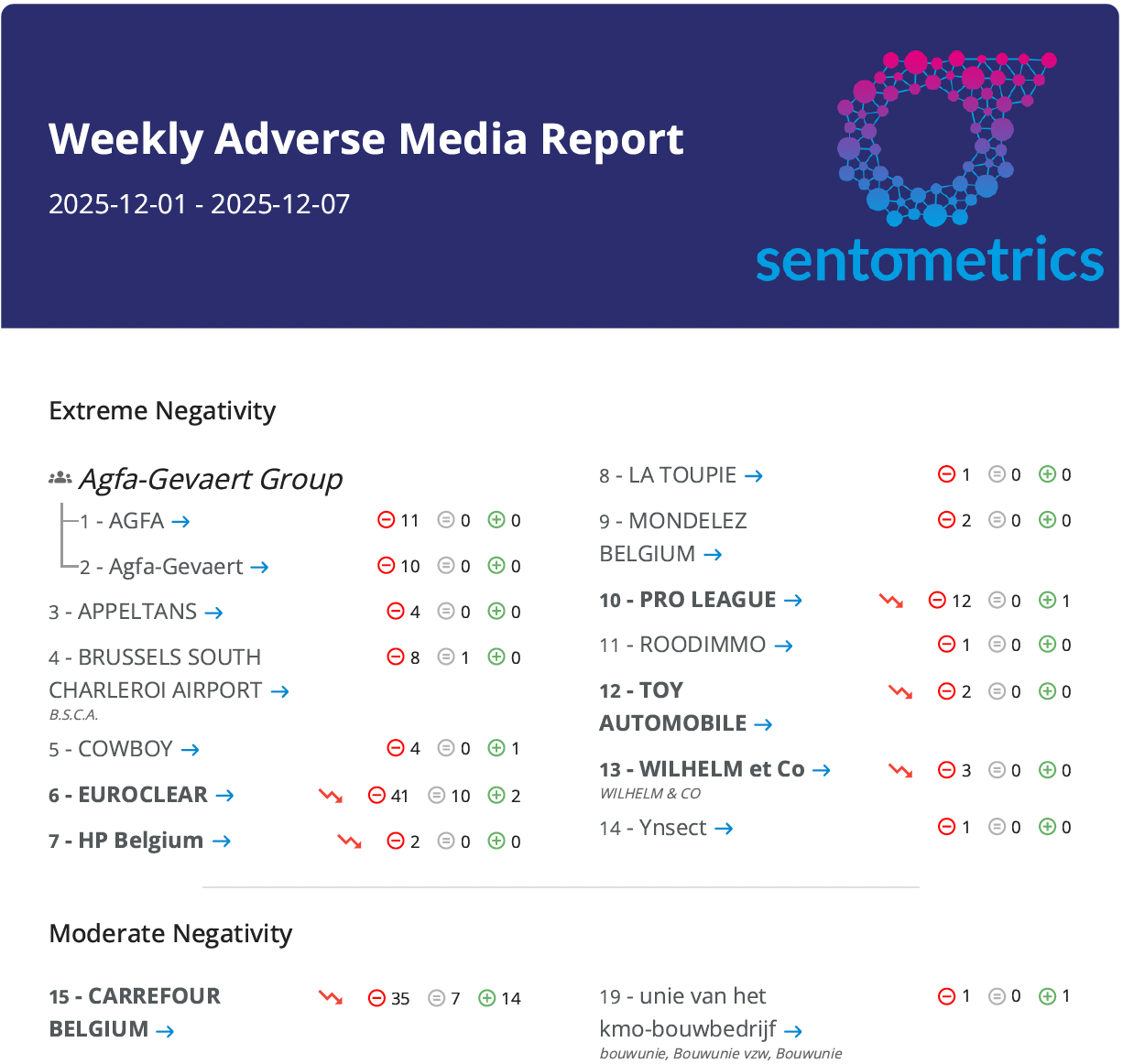

The solution includes regular adverse media reports for monitored companies, highlighting verified negative news events that may indicate emerging credit risks.

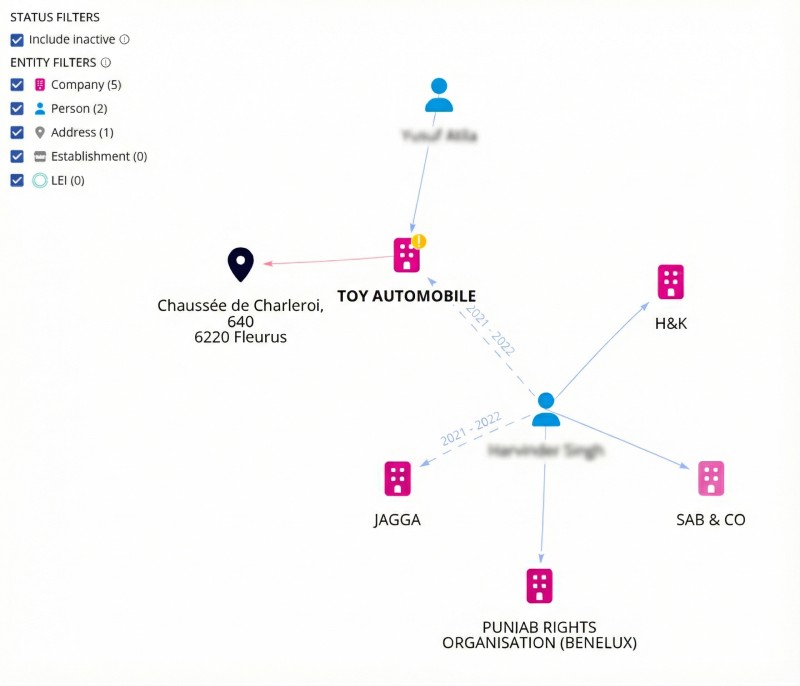

These reports are complemented by time-series indicators of media sentiment and attention, as well as network visualizations linking adverse events to corporate group structures.

Adverse Media Reports

Receive a consolidated, verified overview of adverse media related to your corporate borrowers, delivered in a structured adverse media report.

Early warnings are grouped across corporate hierarchies, providing a clear view of risk at both entity and group level. The interactive PDF allows you to drill down instantly – simply click on any adverse media warning to access the underlying sources and detailed context.

Explore each adverse media warning in detail through concise summaries and direct access to the original source articles – giving you a complete, transparent understanding of every adverse media warning.

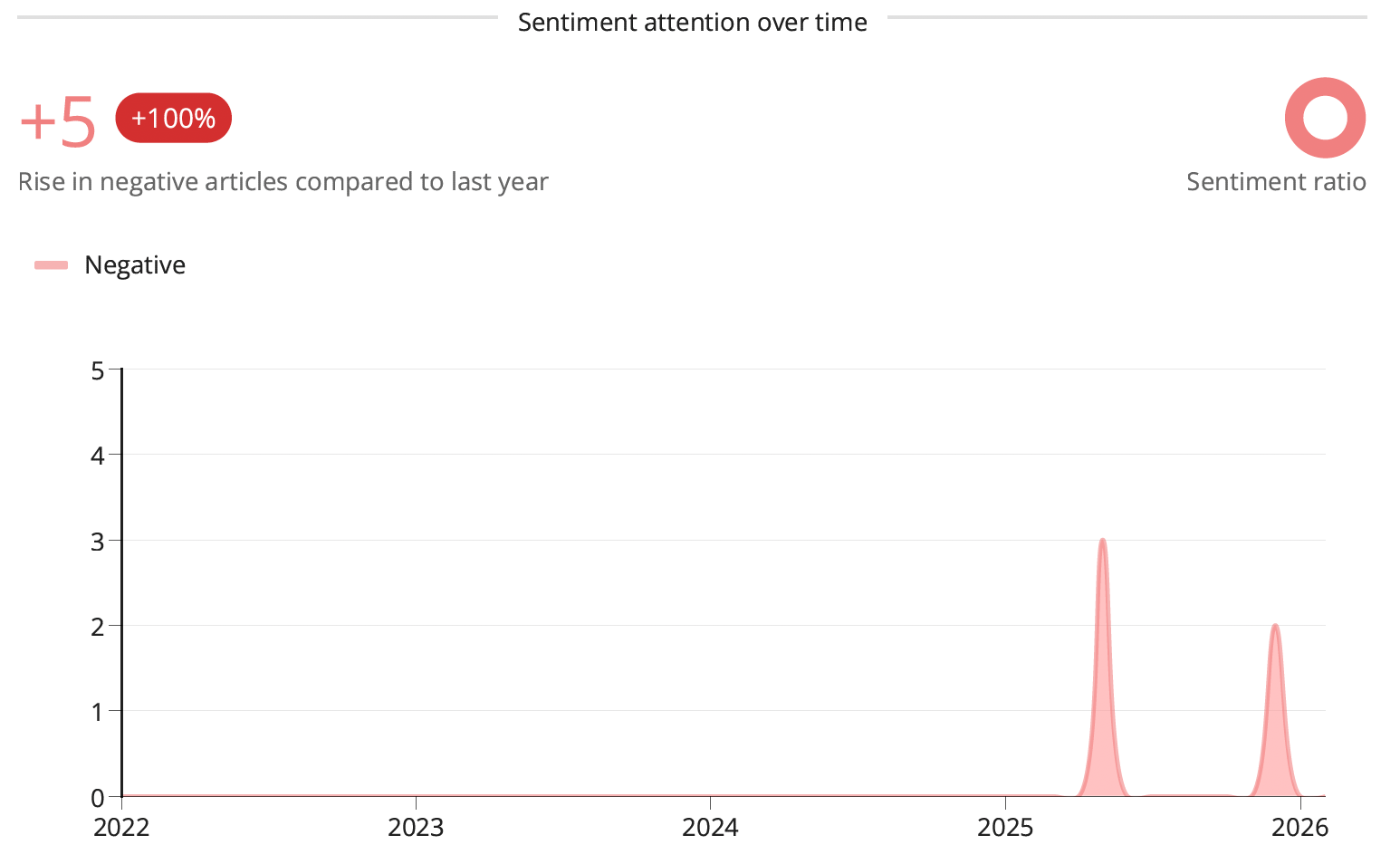

Analyze a company’s historical media coverage to see when adverse media spikes occur, helping distinguish isolated incidents from persistent negative coverage over time.

Link each adverse media event directly to the network graph to map risk across corporate groups, shareholders, and directors — providing a complete view of all companies and individuals exposed to the adverse media warning.

Time series data

Our data complements existing early warning signals by integrating seamlessly into time-series models to monitor thousands of corporate borrowers and is readily accessible via API within your data architecture.

| Month | Company ID | Negative sentiment score | Negative sentiment burst | Negative article count | Positive article count | Neutral article count |

|---|---|---|---|---|---|---|

| 2025-01 | ACME Corp | 0.44 | 0.30 | 4 | 5 | 1 |

| 2025-02 | ACME Corp | 1.00 | 0.29 | 2 | 0 | 0 |

| 2025-03 | ACME Corp | 0.33 | 0.08 | 2 | 4 | 5 |

| 2025-04 | ACME Corp | 0.50 | 0.28 | 5 | 5 | 2 |

| 2025-05 | ACME Corp | 0.80 | 0.29 | 4 | 1 | 1 |

Interested in winning by losing less in credit risk?

Contact us to see how our early-warning indicators, informed by adverse news, support proactive monitoring.